It’s not every day, especially in the market conditions of today, that you can find a great company at an equally great price, so when Secure Trust Bank (LSE:STB) popped up in my ‘value’ stock screener, I took to looking into it with a healthy scepticism. To my surprise, however, I’m happy to report that the bank has a long and successful track record, and I estimate that the stock, currently trading at £10.30 per share, is undervalued by between 50% – 140%! This has been estimated using a dividend discount model, which I’ll come onto later, but I believe this is one of the best value opportunities I have seen in 2021.

Strong Track Record

Secure Trust Bank Plc is a straight-forward deposit taking lender, operating solely in the UK & headquartered in Solihull in the West Midlands, and is regulated by the FCA & PRA. The company’s lending portfolio is split broadly equally between Consumer Finance and Business Finance portfolios, with the largest revenues being earned in the Retail Finance, Real Estate Finance, and Motor Finance segments.

The company was incorporated in 1954 and has a long track record in the industry. The company was listed on the AIM in 2011 but currently trades on the main LSE market.

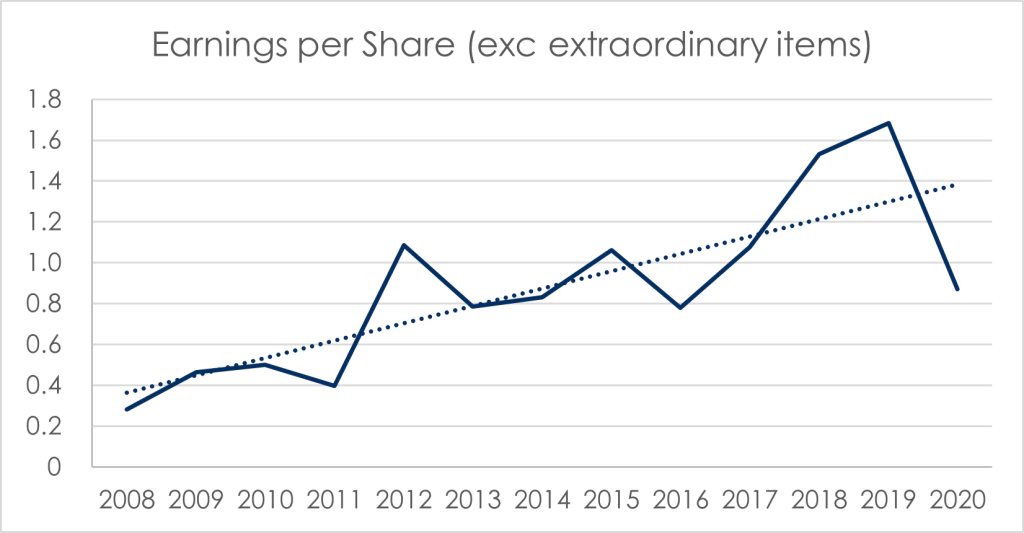

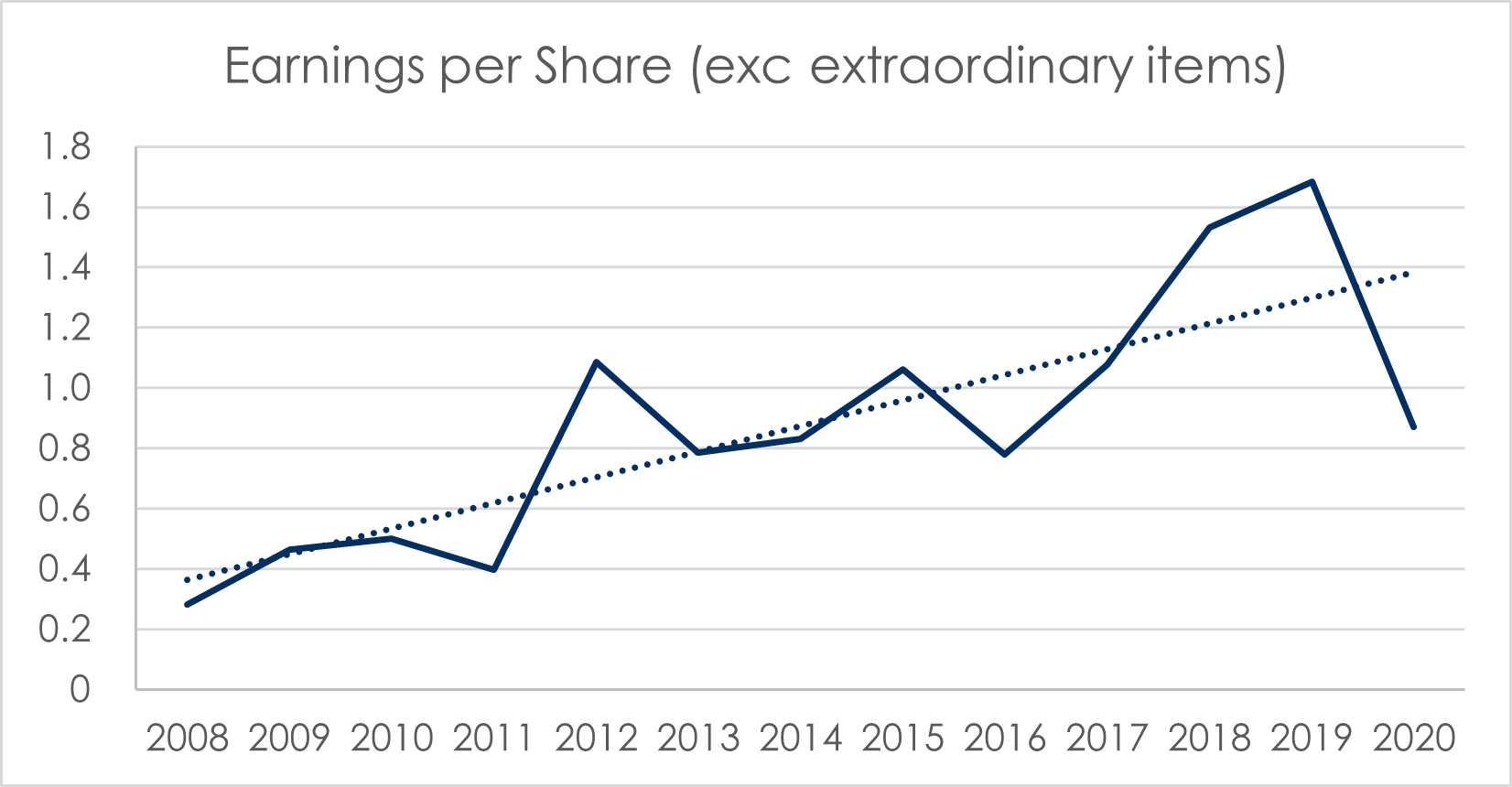

In the last few years the company has shown strong organic growth with EPS climbing from 80p per share in 2016 to over £1.60 in 2019. This is despite a challenging interest rate environment for banks which has depressed valuations across the sector.

STB has focussed its strategy on higher yielding specialist lending coupled with a lower level of leverage on the balance sheet (i.e. with a higher ratio of capital to lending assets), which has allowed it to maintain a strong net interest margin which is far less sensitive to changes in interest rates as compared to lower yielding lending areas such as standard residential mortgages. This has allowed STB to increase its net interest & fee revenues before loan losses from £107m in 2016 to over £160m in 2019 & 2020.

Over this period the bank has also maintained a strong balance sheet position, exceeding minimum regulatory requirements throughout. As at 31 December 2020 the bank maintained a Tier 1 capital ratio of 14.6%.

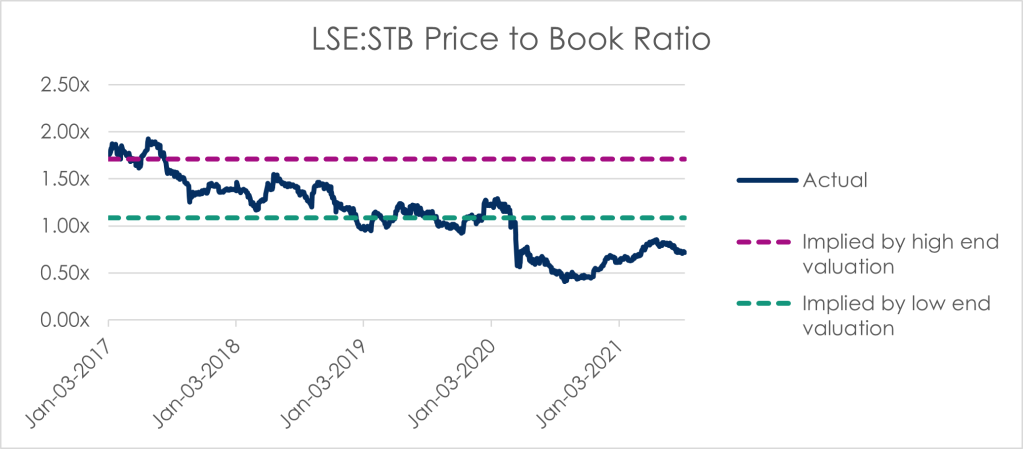

This strong performance, up until the COVID-19 pandemic, was understood by the market and reflected in the share price, with the stock trading at a premium to book value of around 20% (i.e P/B ratio ~1.2x). The bank currently trades at a 30% discount to book value. The question for the prospective investor is, has COVID-19 permanently damaged the company’s ability to earn cashflow and grow, and if not, how long could the recovery take?

Temporary Adversity

“Experience teaches that the time to buy stocks is when their price is unduly depressed by temporary adversity. In other words, they should be bought on a bargain basis or not at all.” – Benjamin Graham

In 2020 the COVID-19 pandemic has taken a large toll on economies across the globe where economic activity has declined due to various government restrictions. This has a direct impact for banks like STB, because not only are current borrowers less likely to be able to make repayments, but there is also a smaller pool of credible borrowers from which the bank can choose to lend to.

This is the backdrop to which the gross loan balance fell from £2.65Bn in 2019 to £2.54Bn in 2020, as the bank tightened is lending criteria, which resulted in net interest & fee revenues before loan losses flatlining from £165.5m in 2019 to £163m in 2020. In addition, the impairment charge relating to bad loans for the year increased to £32m in 2019 to £51m in 2020, which knocked down net earnings for the year from £39m in 2019 to £20m in 2020.

Despite this the banks portfolio focus looks well poised to benefit from an economic recovery. Taking each of the 3 largest portfolios in turn:

- Real Estate Finance: the bank offers financing for primarily residential development & investment, with little exposure to commercial properties which have suffered significantly in the pandemic. Moreover, the bank lending criteria is tight. The average gross development value LTV (loan to value ratio) is below 60%, providing significant protection against property market turmoil.

- Retail Finance: retail has suffered as one might expect during the pandemic; however it is expected to bounce back strongly and lending levels should recover as a result. https://uk.news.yahoo.com/consumer-money-retail-sales-uk-economy-centre-for-retail-research-coronavirus-115405605.html.

- Motor Finance: the automotive industry has suffered in the past few years; however this has bounced back sharply in 2021 and this recovery is expected to continue over the next few years, which should provide sufficient demand to STB.

It is rather miraculous that a bank such as this could still turn a profit after several lockdowns, and this would not have been so if it were not for government support schemes, designed to support employees & employers in vulnerable industries.

In the UK, the government has introduced the Job Retention Scheme, or ‘furlough’, whereby the government would meet to cost of a large portion of employers salary bill, which has in effect prevented a large number of defaults from occurring. Moreover, the government introduced government backed loans scheme (BILS, CBILS, CLBILS), where between 80-100% of loans offered under the scheme would be guaranteed by the government, which have likewise benefitted participating banks.

Acknowledging the good fortune that the banks have been afforded in this regard, there are three key reasons why I believe that the key challenges faced by the STB are temporary in nature, and therefore why a patient investor could be set to benefit from the return to normality which will surely, I hope, unfold:

- Undiminished capital. For a lending bank such as this, the single most important thing in terms of earnings potential is the level of capital held. Despite the COVID-19 pandemic the company has not a smaller, but a larger capital base. And under the worst macroeconomic outlook considered in the banks modelling, the expected credit losses calculated would be an additional c. £16m for 2020, still not enough to turn the £20m profit into a loss. This means that as the UK economy recovers, which it should following the successful vaccine rollout and relaxation of restrictions, the earning potential of STB should not be diminished either. However, to earn a higher valuation STB needs not only to return its previous earnings, but to be able to grow them further, which brings me to point 2.

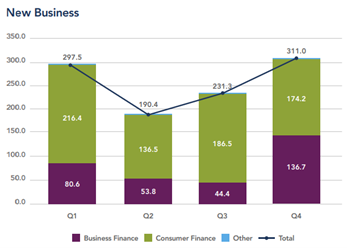

- A small bank with room to grow. The size of bank, with total equity less than £300m, should allow it to be nimble and to continue to grow as it has done before the COVID-19 pandemic began, which is expected in analyst forecasts, so long as the UK economy does indeed recover. The graph below, released as part of year-end results for 2020, shows that new lending had started to recover even before the end of 2020.

- Forward looking credit losses accounting. Mr. Market may look at the >£50m charge in 2020 with some dismay, and he or she may expect that this might represent a new normal for the bank, but there are some features in the accounting treatment for credit losses which should give investors hope. Under IFRS9 banks are required to record not just credit losses which have been incurred (as used to be the case under IAS39), but to record expected credit losses for loans looking into the future, for all loans. There are two key results of this to consider:

- little credit losses for the bank have crystallized, and could still be recovered (2020 annual report: “No credit losses crystallised on either of these portfolios during the year. In line with the overall Group position, the higher impairment charges borne this year reflect the forward-looking factors built into IFRS 9 methodology.”). This means that if conditions improve, writebacks of impairment can be expected.

- because credit losses are forward looking, the level of losses are not likely to be repetitively high. Under the accounting rules all loans are classified as Stage 1, 2 or 3. Loans begin in Stage 1, if they have significant credit deterioration, they move to Stage 2, and if it is defaulted it moves to Stage 3. If a loan is Stage 2 or 3, then the expected losses over the full life of the loan are recognized as an expense in the current period. This means that for bad loans, all future losses should be encapsulated in the current year charge (with exception to the unwind of discounting), and therefore credit losses are much more ‘one-off’ than they used to be.

As a result there is no reason to believe credit losses will persist for the bank at a level near £50m per annum, and that this will weigh down the earnings recovery for the bank.

Surely Undervalued

DCF Model

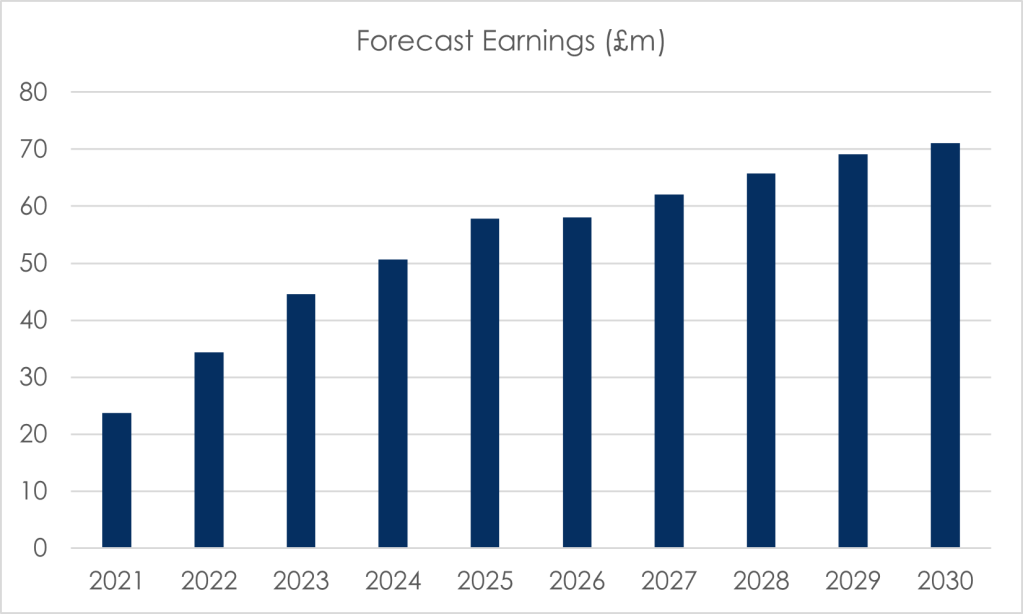

In order to value the bank, I have put together a Dividend Discount Model (‘DDM’) using a calculated cost of equity (Ke) and using forecasts broadly in line with consensus.

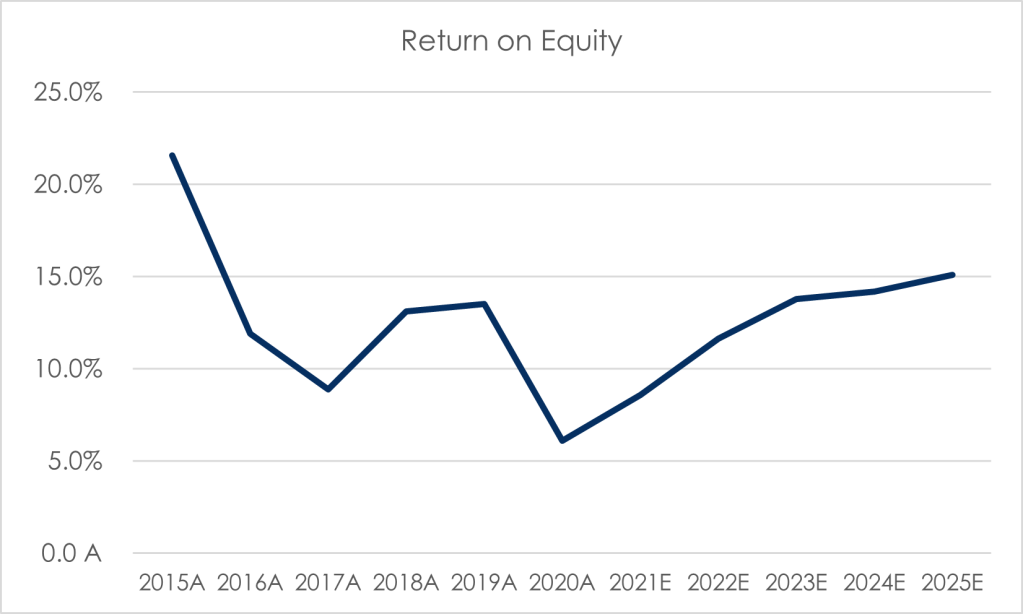

These forecasts may look quite bullish, on first glance at least, but the implied Return on Equity is in line with what has been achieved in the past and what is targeted by management.

Edit: the day after publishing this article, STB announced that they anticipate beating 2021 earnings expectations, with annual earnings now expected at around £29.5m.

I’ve estimated Ke at between 10% – 12.5% using the CAPM model, considering observed betas across the market, with the addition of a small market premium (however dubious I personally believe this to be).

This has been used to discount expected dividends up to 2030 calculated using a payout % of c. 42.5% based on the past 5 years dividends, before a terminal value calculation using the standard DDM formula.

The resultant calculation gives an equity value range of between £262m and £463m, or between £15.70 and £24.80 per share, significantly higher than the current price level of £10.30 per share. Moreover, my sensitivities show that the applied Ke would need to rise to 16.2% for the equity value of STB to be equal to the current share price.

It is understandable that some feel sheepish regarding the UK economy at present, but for me a 16.2% Ke is beyond excessive in context with valuations across other sectors.

Multiples

Up until the COVID-19 pandemic, STB traded at a premium to book value, reflecting its growth prospects and earning potential.

As shown above, my valuation results in an implied P/B ratio of between 1.0x – 1.7x, which is broadly consistent with the P/B ratio observed for the stock in the few years preceding COVID-19.

I would note that a depressed P/B ratio is not unique to STB, but for a bank that is profitable and with growth potential, a discount to book value does not appear reasonable.

Conclusion

Ultimately your view on Secure Trust Bank Plc will be highly dependent on your view of the UK economy. In my view, the market is excessively overcompensating for the risks associated with COVID-19 and Brexit on the economy. A patient investor can wait for things to get back to normal and see STB profit from its undiminished capital base.

The bank itself has a business model which is well suited to cope with low interest rates and has sufficiently specialized areas of focus to effectively manage risk whilst maintaining good yields, not to mention strong LTV levels across its secured lending.

Target price: £18. Conclusion: bargain share. Bought at £10.30.

Great piece on STB. Feels like the the share price is being held down by Arbuthhot seeling down its stake along with Invesco and Schroders. I’m surprised at the latter 2.Nevertheless, this creates a good opportunity.

What are your thought on an interim dividend in August .Surely they would be in a position to pay one now and thereby get closer to a 5.5% dividend yield for the current year ?

LikeLike

Hi Keten, thanks so much for the feedback.

For me personally I tend to be quite agnostic towards dividend payout, so long as the company can put capital to good use, though I do note it is a net gain for shareholders at current price levels below net book value.

I hadn’t given this much thought, but don’t think that’s unlikely given the trading statement they just came out with and considering the BoE relaxation of dividend restrictions for other banks – we shall see!

LikeLike

Hi Eddie ,

I’m glad to see they reinstated the interim dividend . Have you any further thoughts on STB as seemingly , they look well on course to beating your estimates ? I’ve added another 4k today at 13.90 as they still seem very undervalued. Hopefully , they will reveal a lot more at the CMD in November.

Thanks,

Keten

LikeLike

Hi Keten,

It’s been good news on the whole since I published this, and you are right that the estimates I cited for this year look well beaten, so I would expect my target of £18 to be revised upwards to some degree.

That being said, most of the value in STB is in the long term earning potential, which was reflected in my model, so the uplift in valuation might be marginal.

Also, as I alluded to in my article, there was a write-back in impairment provisions (£1m) which makes H1 earnings of £26m look even stronger. Considering ‘normalised’ impairment charges in FY18 & FY19 of c.£30m, you might expect full year earnings at around £40m-£45m. Still well ahead of estimates, but worth keeping in mind.

I intend to post a full update soon!

Cheers

LikeLike

Now that the ARBB stake has finally been cleared , I think we should see some movement towards your target. With the PCP and BNPL launches this year STB are confident to raise their lending target. This augers well that FY2022 forecasts should be beaten despite the impairment charge rising. The CMD was great in this regard and it looks like a very steady share in a rising interest rate environment having invested a lot in technology in greater digital engagement.

I’m expecting funds MUST increase their STB exposure this summer so volumes should be high and have been adding aggressively the past month….latest top up of 5k today.

LikeLike